In 2018, about 23,000 MLS transactions occurred in Greater Vancouver, of which about three percent were developer pre-sales or pre-sale assignments, and the majority of which were related to apartments. Common-wisdom suggests that purchasing a pre-sale property saves the buyer money, but is that actually the case?

For this article, we had our data scientists at Roomvu gather Greater Vancouver MLS data from 2004 to mid-2019 and compare the average sale price of Vancouver pre-sale attached properties (condos and townhouses) versus their newly built comparables (built-in that year or the year before). In doing so, they found out something that goes against what you might expect.

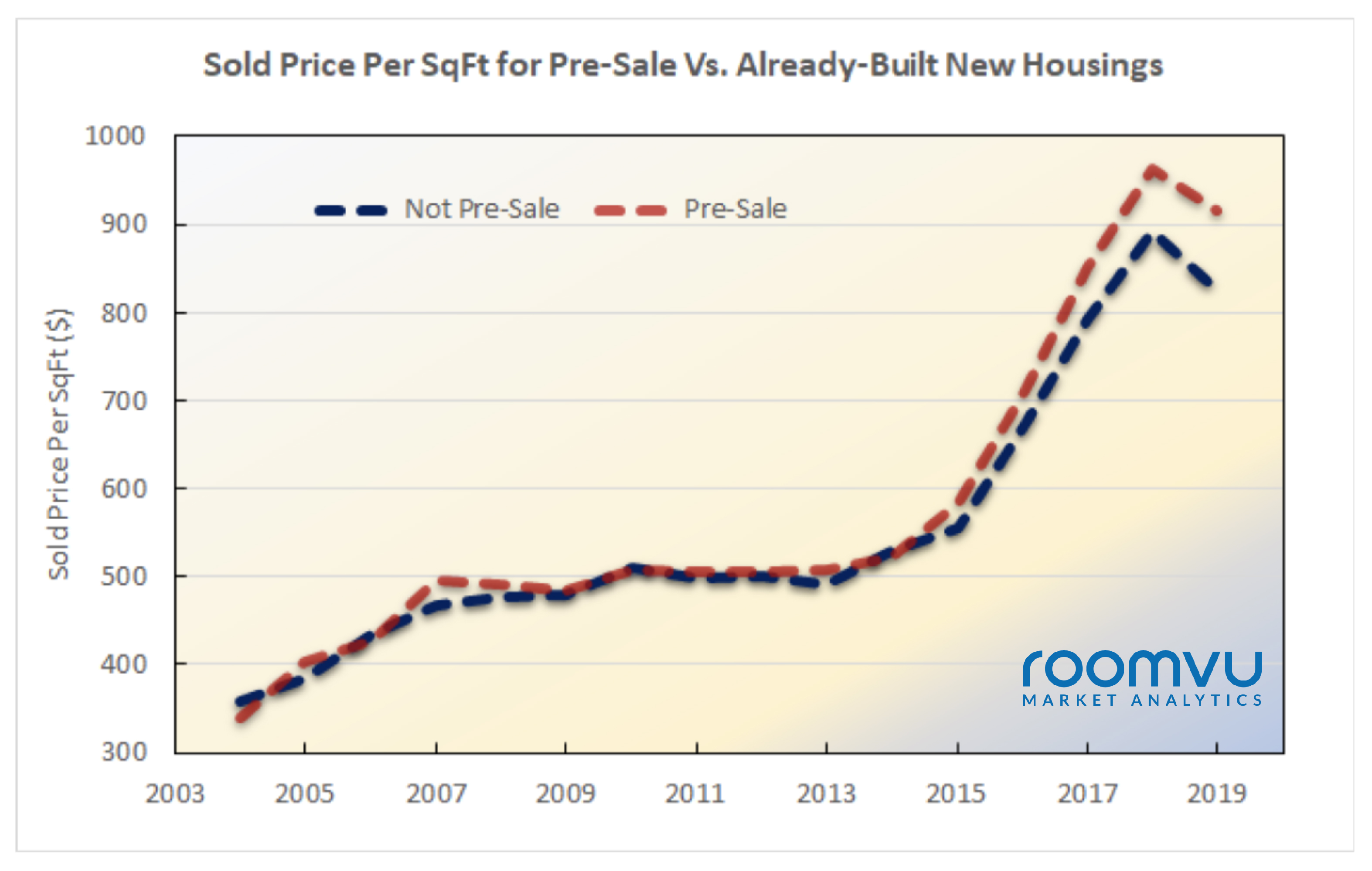

After 2015, Vancouver pre-sales became more expensive than already-built properties even before GST included

Before 2015, both pre-sale properties and those that were already-built sold, more or less, for the same price, while after 2015, pre-sales became more expensive, even before GST is included. This is surprising for a number of reasons, namely because pre-sales carry a lot of added risks.

Figure 1: Sold Price Per SqFt for Pre-Sales Vs. Already-Built New Housing (Yearly-Trend)

Vancouver pre-sale units sold for, on average, $16-$28/SqFt more than already-built properties

In addition to sales prices, our data scientists used different linear regression models to analyze the price difference of pre-sales on a per-square-foot basis versus already-built units. In Greater Vancouver, pre-sale units sold for about 16$ to $28 per-square-foot more compared with already-built units, despite the fact that these properties were similar in qualities (number of bedrooms and bathrooms, floor area, subarea, etc.) per-square-foot.

A factor that may have influenced high prices for pre-sales since 2016, could be the foreign buyer’s tax which came into force on August 2nd, 2016 focusing on controlling foreign investment which was considered a major contributor to the rapid rise in Vancouver home prices. After this new law, foreign buyers and other investors were encouraged to buy pre-sale listings since they could delay paying the tax until after ownership.

Another reason that may have influenced the high prices for pre-sales in 2016 could be the B20 Mortgage Stress Test which may have increased the demand for pre-sales. As of Jan 1, 2018 Canadians getting a mortgage must undergo a ‘Stress Test’, proving that they would be financially OK even if interest rates were to rise substantially above their actual mortgage rate. This new rule meant that potential buyers may not be able to borrow as much as they would have been able to before the start of the year.

CEO of Roomvu and realtor in Greater Vancouver, Sam Mehrbod, says “these two factors may play a significant role on increased demands for pre-sales, as for many foreign home buyers, it enables them to not have to pay the tax until the construction is finished–which means they can either resale for profit to third parties, or hopefully have an immigration status in Canada. On the other hand, local home buyers often choose pre-sales since it enables them to accumulate more down payment or find higher-paying jobs by the time the building is ready for occupying.”

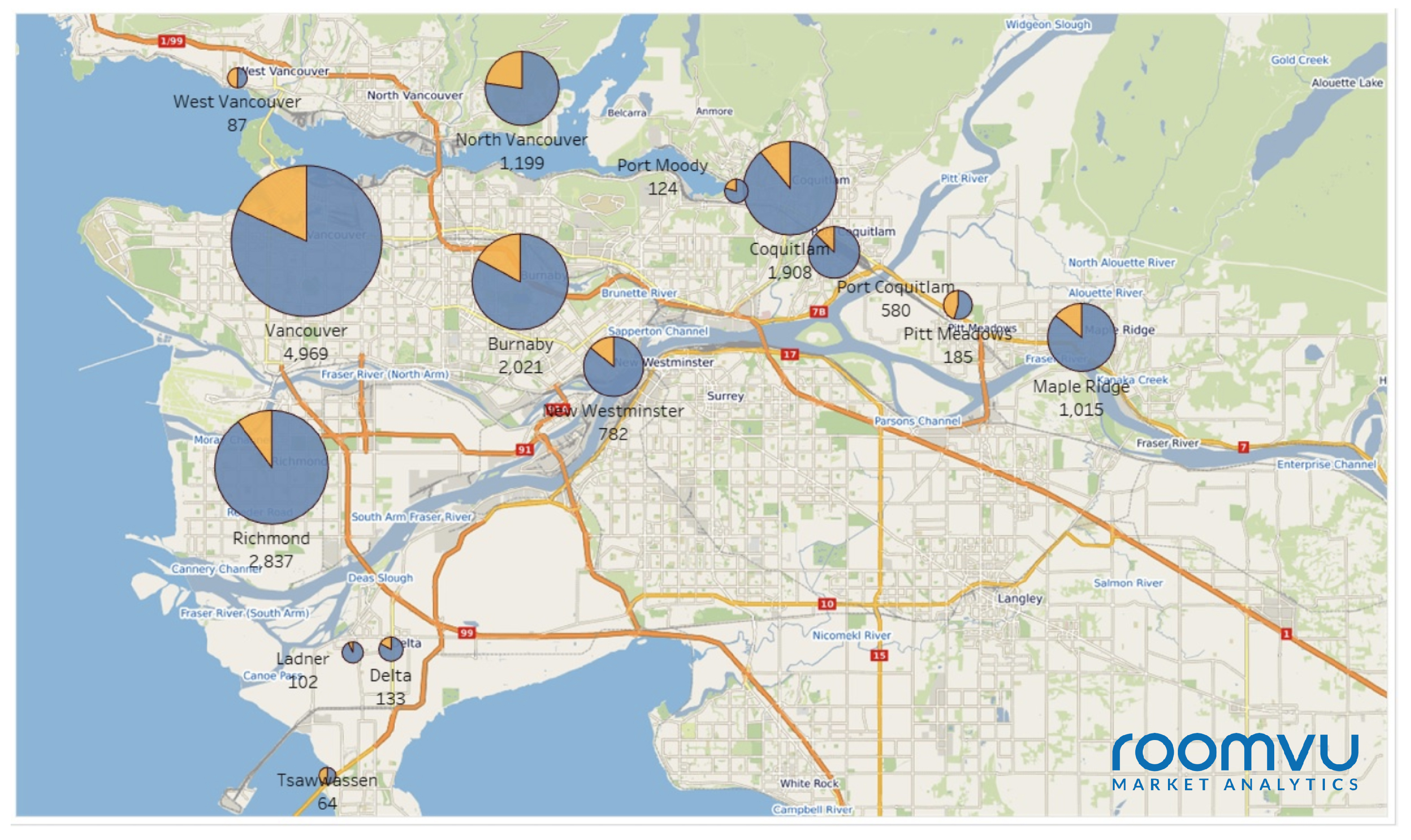

Figure 2: Sold Price Per SqFt for Pre-Sales Vs. Already-Built Properties (City Trend)

But Vancouevr pre-sale properties being sold for more than already-built properties is not the case for every city

Although pre-sale units are being sold at higher prices in comparison to already-built units, this is not the case for every city in the Greater Vancouver region. For instance, a statistical comparison between the average sold price of pre-sale units versus already-built units, for the last five years, shows that pre-sales in Port Moody, West Vancouver, Pitt Meadows, and Maple Ridge have been selling at an inflated price. On the other hand, pre-sale units in North Vancouver, Burnaby, Richmond and New Westminster were sold around the same price.

We believe a contributing factor to this could be the increased supply of new developments in North Vancouver, Burnaby, Richmond and New Westminster. Since there were more choices available to the consumers in these municipalities, the developers were incentivized to offer deeper discounts.

The map below shows the number of pre-sales and already-built units since 2016 in the Greater Vancouver area. The larger the circle, the greater the total number of sales in that city. The city of Vancouver had 5000 sales in new apartments and townhouses in the last four years. However, the blue part in the pie charts for each city represents the non-pre-sale market share, while the orange part illustrates the pre-sale market share in each city. It would seem that Pitt Meadow, Tsawassen and North Vancouver had the greatest market of pre-sales.

Figure 3: The Number of Pre-Sales Vs. Already-Built Sales Since 2016 in Greater Vancouver

Homebuyers are more likely to buy Vancouver pre-sales either as a bachelor suite or 3 bedroom suites

We have also compared the number of bedrooms in pre-sale transactions during the last four years. This table shows the breakdown of units per different numbers of bedrooms.

Table 1: The average number of bedrooms in pre-sales in the last 4 years

| Condo Size | Percent pre-sale |

| Bachelor Suite | 7% |

| 1 Bedroom | 11% |

| 2 Bedrooms | 18% |

| 3 Bedrooms | 20% |

| 4 and More | 16% |

It is clear that three-bedroom units are more likely (18%) and bachelor studio units are less likely (7%) to be sold in a pre-sale contract.

We can say with some certainty that the pre-sale transactions are nowadays being sold at a higher price compared to the already-built units with similar specifications. This is not the case for all municipalities in Greater Vancouver, but for Port Moody, West Vancouver, Pitt Meadows, and Maple Ridge this tends to be the case. What’s more, the majority of pre-sale transactions involve three and two-bedroom apartments or townhouses.

Responses