Summary

- Calgary’s real estate market is showing signs of recovery as COVID fears start to ease for both buyers and sellers.

- Total residential property sales and listings in May have rallied a remarkable 89% and 70% respectively from April’s record lows.

- Despite gains in May, the market has not yet completely recovered: May sales have declined by 44% YoY resulting in supply growth, particularly in high-end segments of the market.

- High levels of job-loss among skilled professionals are driving buyers to leave the high-end housing market, suggesting a longer recovery time for this market segment.

- Median prices for homes are trending downwards, as more affordable housing segments gain a larger market share; this is expected to stabilize over the course of 2020.

As COVID-19 developed into a full-blown public health crisis, the Calgary real estate market slumped to record lows in April 2020. Consequently, potential buyers and sellers are waiting for the situation to unfold, pressing pause on a real estate market that had already been weathering the effects of a downturn in the energy sector. However, with lockdown measures starting to ease across Canada, realtors in Calgary can start breathing a sigh of relief.

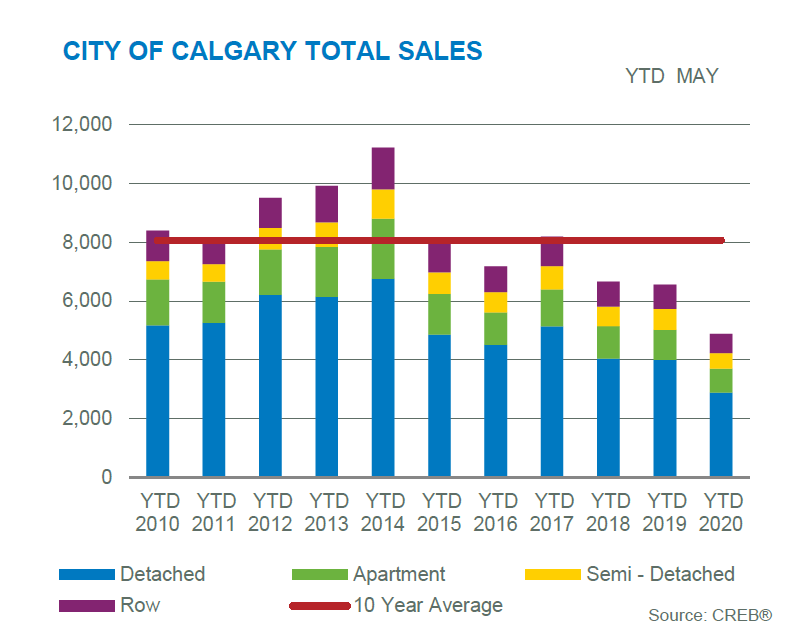

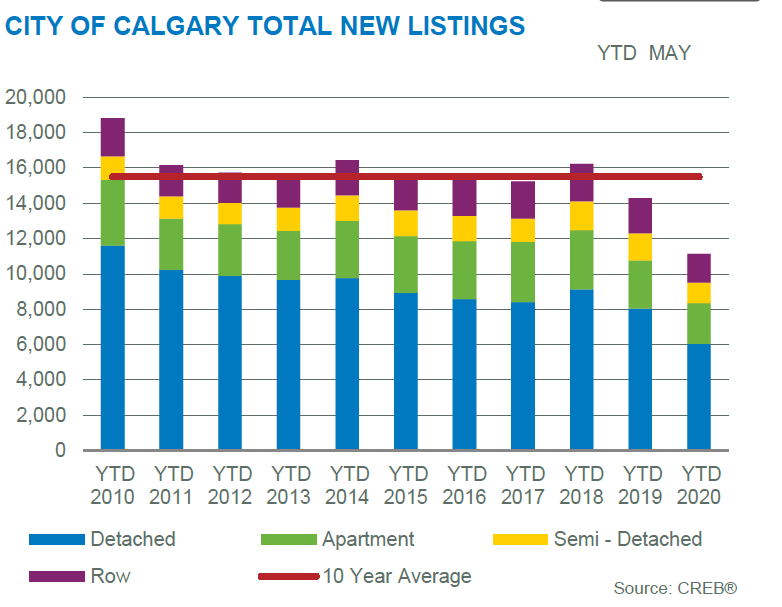

A recent report by the CREB (Calgary Real Estate Board) reveals an encouraging development. May sales have increased by 89% from April. What’s more, the number of listings for residential properties has grown by 70%, indicating buyers and sellers are starting to return to the market. Nonetheless, the market still faces a long road to recovery, as year-to-date (YTD) sales are down by 25.6% and total listings by 20.9%.

The steep decline is illustrated in figures 1 and 2, where current YTD sales are lower for all property types, and remain well below the 10-year average.

Ann-Marie Lurie, chief economist at CREB, anticipates market activities to recover by Q3 and Q4 as social distancing measures ease, restoring consumers’ confidence to start shopping for real estate. “With social distancing expected to soften by the third quarter, the pace of the decline in sales will ease by the third and fourth quarter,” Lurie noted in an interview with the Calgary Sun.

The Federal Government’s $1.7B package to clean up orphaned oil wells in Alberta, BC, and Saskatchewan is also expected to hasten the recovery process by creating new jobs for Albertans, potentially spurring new investment in the real estate sector. The stimulus package is anticipated to create 5,200 jobs in Alberta, which is likely to provide a much-needed boost to real estate and other sectors of the economy.

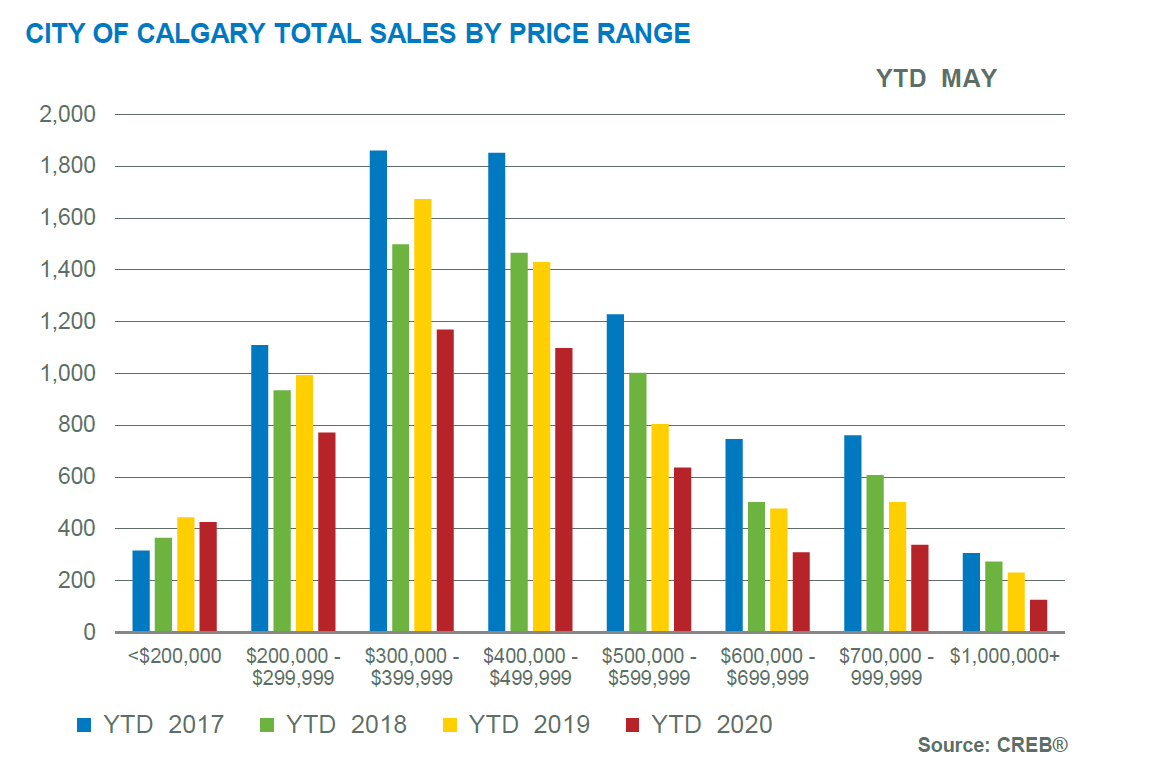

However, Lurie noted that overall sales numbers are not expected to catch-up to 2019 levels by the end of the year, as households are recovering from the impact of COVID-19. Unemployment still remains high among the higher-paid energy and tech sectors, creating additional stress on the high-end segment of the market which may take longer to recover. Figure 3 shows the falling number of YTD May sales in 2020 has been markedly sharp for high-value properties in the market.

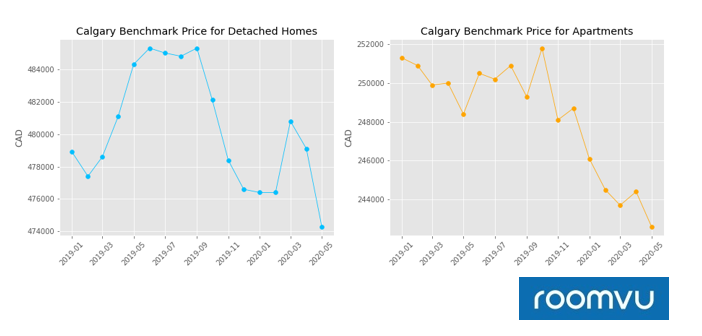

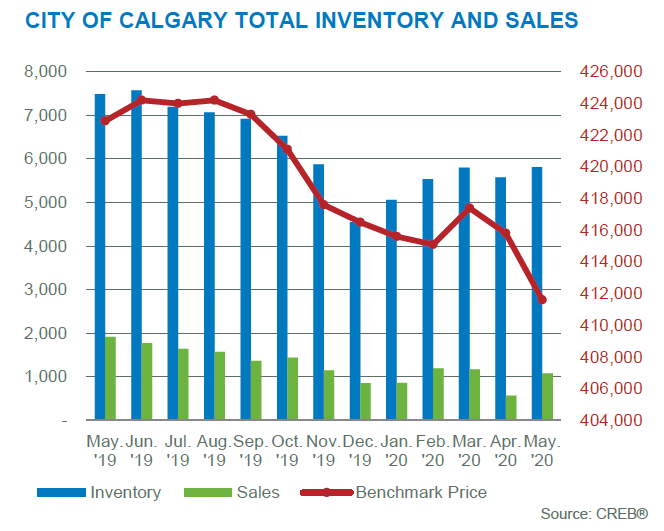

While market activities have begun to resume in May, real estate prices didn’t experience the same recovery, as benchmark prices for all properties continue to decline. Benchmark prices for real estate in Calgary have more or less experienced a downward trend over the last year due to an oversupply problem. The current concern over COVID added a new layer of downward pressure on price as more buyers than sellers exit the market, compounding the already persistent oversupply problem.

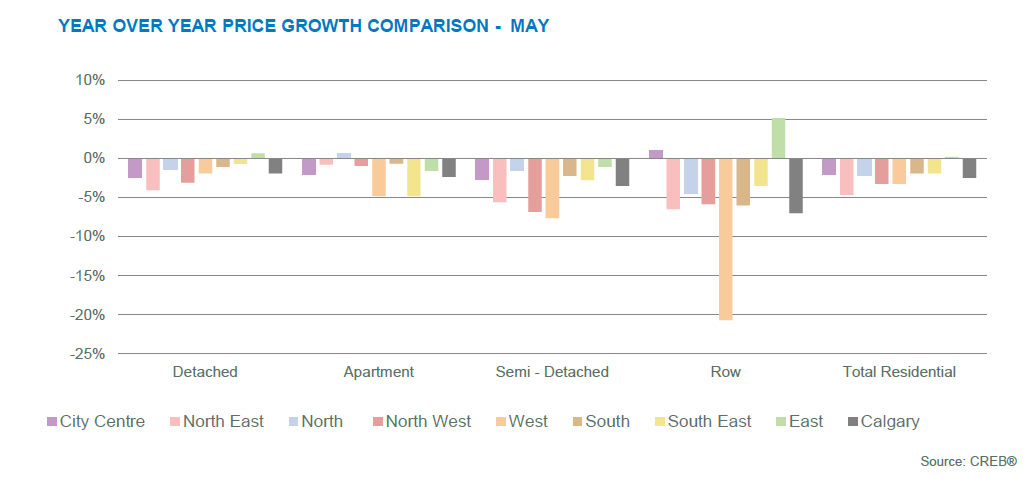

Figure 3 shows the evolution of benchmark prices from the start of 2019 for detached homes and apartments, indicating that prices of real estate in Calgary have fallen significantly below 2019 levels by May 2020. Figure 4 indicates that compared to last year, declines in prices have been uniform across all major areas in Calgary. The West, North-West, and North-East districts experienced the sharpest price decline over this period. Figure 5 shows a trend in growing home inventory in Calgary over the course of 2020, coinciding with a price decline over this period.

Justin Havre, an award-winning real estate agent, weighed in on the issue, noting that higher degrees of competition for buyers may affect selling prices. “You’ve got to be realistic on that pricing because you’ve got to be competitive,” he mentioned in an interview with Global News, acknowledging that Calgary is becoming a buyers’ market.

Ann-Marie Lurie struck a different tone. She anticipates the number of listings will decline as homeowners delay putting their home on the market, Lurie expects less competition in the market for sellers.

Despite the decline in the first-half of the year, the CREB anticipates prices will stabilize over the course of the year in Q3 and Q4, as additional support measures from the Federal Government are expected to prevent a price collapse.

Realtors operating in the uncertain Calgary environment will have to adapt to the reality of a post-Covid market where two particular trends are emerging. Despite lower numbers of buyers in the market, Justin Havre noted that buyers are more serious about their intention to secure property, providing opportunities for the remaining sellers in the market. Additionally, agents are starting to leverage technology to adapt to this new reality by engaging with prospective buyers through virtual tours and 3-D rendering. In the post-COVID world, this technology has potential as a way for agents to weed out less serious buyers.

“We’re implementing technology that’s available to us to ensure that there’s less disruption for homeowners,” Havre added.

The market effects of COVID-19 on Alberta’s major cities have been somewhat more acute than in other Canadian cities due to the energy sector’s downturn. The market rebound observed in May from April is likely to continue as pandemic-related lockdown measures continue to ease and consumer confidence is restored. But a return to pre-COVID levels is unlikely to be seen in 2020—and whatever the new normal will be, remains uncertain.