COVID-19 forced a drop in sales for Greater Vancouver condos, according to a new data report by Roomvu and UBC Economist.

Vancouver, BC, Canada – May 21, 2020 — The current COVID-19 pandemic hit Greater Vancouver’s real estate market hard, with sales activity virtually disappearing overnight starting in mid-March.

The slow sales activity is a warning sign, according to Thomas Davidoff, economist and professor at UBC’s Sauder School of Business. “Low transaction volumes typically lead to low prices; however, prices have remained stable [given that] sellers and buyers appear have disappeared from the market in similar proportions.”

While average sales prices appear to be stable, new analysis by Roomvu, a real estate digital marketing provider, shows that sold prices are starting to slip when comparing pre and post-COVID-19 prices to assessed values.

“There are difficulties when comparing pre- and post-Coronavirus average or median sale prices,” explains Sam Mehrbod, A local Realtor and Roomvu’s CEO. “Average prices can quickly become skewed based on outliers, while median prices require ongoing trends to provide meaningful data.”

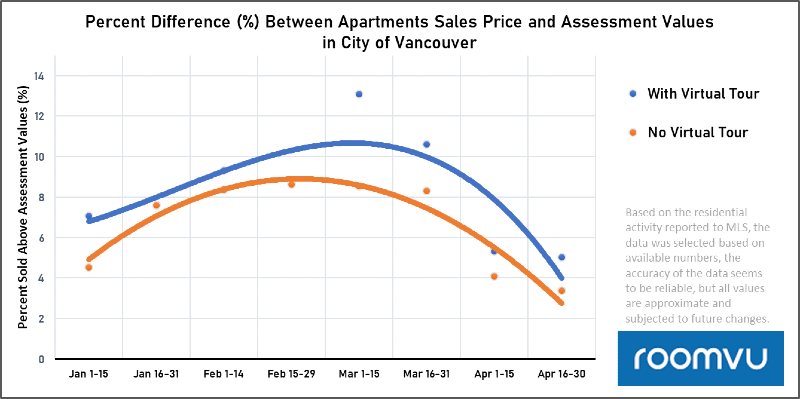

For these reasons, Roomvu examined pre-pandemic sales prices as they related to the property assessment values and compared this to post-pandemic sales prices, as they relate to property assessment values.

“Assessment value rises and falls based on all characteristics — sub-area trends, renovations, property attributes and market conditions, among others — that the difference between the sales price and the assessed value can become an excellent measure of a market’s activity,” says Sam Mehrbod.

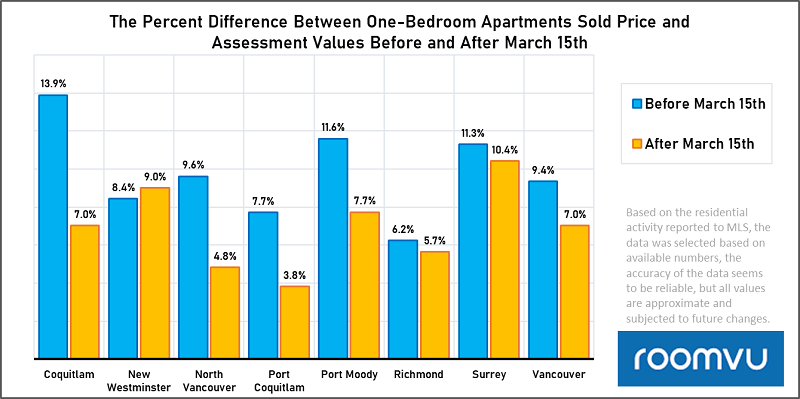

To determine the impact of COVID-19, Roomvu examined sale prices and assessment values before March 15, 2020 and after March 15, 2020 for 1-bedroom and 2-bedroom condos in Greater Vancouver municipal markets.

Pandemic Impact on 1-Bedroom Condos

For 1-bedroom condos, the results show that prior to the pandemic sale prices were higher than assessed values in all but one market, New Westminster. Once the pandemic outbreak hit, sale prices dropped to below the January 2020 assessed value (the property value that was used to measure the coronavirus impact on condo prices in the GVA).

According to the data, 1-bedroom condos sold for 6% to 14% above their assessed values. After March 15, 2020, 1-bedroom condos were selling for only 3% to 10% adobe their assessed value.

“The difference isn’t massive but it does show that the market is slowly shifting,” says Mehrbod. “The market is starting to price in the impact of the Coronavirus.”

The impact of COVID-19 on 1-bedroom condo sale prices was not uniform across Greater Vancouver.

- Port Coquitlam 1-bedroom condos sold, on average, for 8% above assessed value pre-COVID and only 4% above assessed value post-COVID;

- Coquitlam 1-bedroom condos sold, on average, for 14% above assessed value pre-COVID and only 7% above assessed value post-COVID;

- North Vancouver 1-bedroom condos sold, on average, for 9% above assessed value pre-COVID and only 4% above assessed value post-COVID;

- Surrey 1-bedroom condos sold, on average, for 11% above assessed value pre-COVID and dropped to 10% above assessed value post-COVID;

- New Westminster 1-bedroom condos sold, on average, for 8% above assessed value pre-COVID and for 9% above assessed value post-COVID.

Buyers looking for condos deals should consider shopping in the Tri-Cities or on the North Shore.

Sellers in Surrey and New Westminster who still want to list should consider doing so soon, given the strength of the current market.

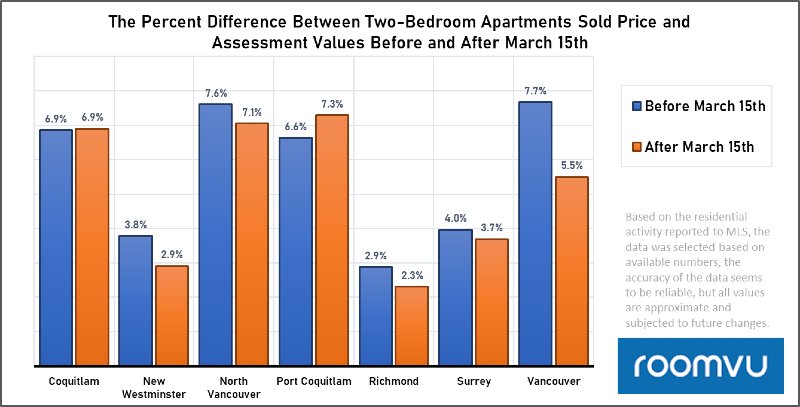

Pandemic Impact on 2-Bedroom Condos

A similar pattern emerged when Roomvu analyzed the sale price to assessed value ratios pre- and post-pandemic.

According to the analysis, 2-bedroom condo sale prices were, as follows, across Greater Vancouver:

- Vancouver 2-bedroom condos sold, on average, for 7.5% above assessed value pre-COVID and only 5% above assessed value post-COVID;

- New Westminster 2-bedroom condos sold, on average, for 3.5% above assessed value pre-COVID and for 2.5% above assessed value post-COVID.

- Coquitlam and Port Coquitlam 2-bedroom condos sold, on average, for 7% above assessed value pre-COVID and rose slightly to 7.5% above assessed value post-COVID;

Sellers in the Tri-Cities who are looking to maximize sale prices in a low-inventory environment should consider listing their properties, despite restrictions imposed by the pandemic.

Buyers looking to purchase in the City of Vancouver should consider getting all pre-approvals in place now, as sellers appear to be incrementally lowering their prices in order to secure a sale.

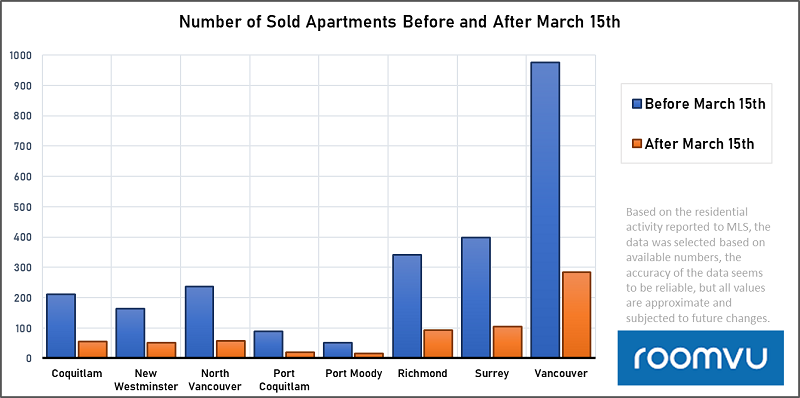

Biggest Pandemic Impact is Sales Volume

To confirm that sales volumes were seriously impacted, Roomvu analyzed the number of one- and two-bedroom condos sold prior to March 15 (a 2.5-month period) and after March 15 (for only a 1.5-month period).

“Conditions in the market appear to have changed less than one might have expected before and after the shutdown,” says Davidoff. “We continue to see a very strong relationship between price point and sales performance, both in terms of sales to listings and price relative to assessment.”

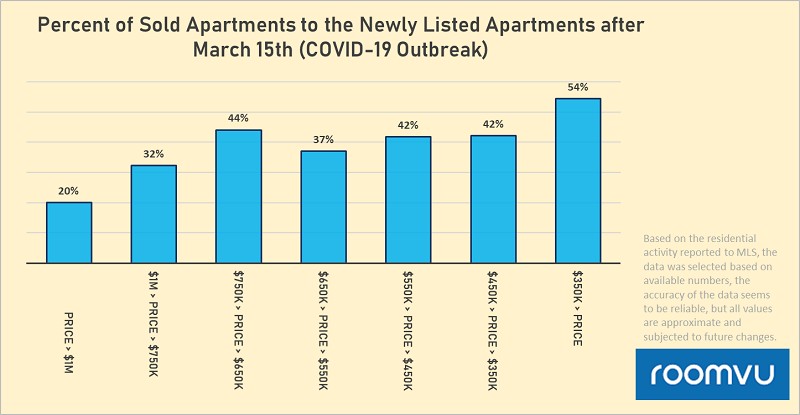

Davidoff points out that sales on the lower-end of the price band are showing a stronger sales performance then property priced higher on the price spectrum.

This observation is clearly represented in the Figure 4 chart, where the higher priced properties, those priced over $1-million, had a lower sales to new listings ratio — at 20% — then properties priced below $350,000, where the sold to new listings ratio was more than double, at 54%.

Industry Adapted Quickly

One of the key factors that enabled the real estate market to survive the pandemic lockdown was the industry’s ability to adopt online and digital tools, such as virtual showings, digital tours, 3D floor plans like those offered by Matterport.

To understand the full impact of virtual tours on the marketing of real estate and housing, please read our report here.

Prior to the pandemic there wasn’t as much emphasis on virtual and online experiences to help aid real estate shoppers during the process of buying and selling a home. But since the World Health Organization announced the pandemic, on March 11, 2020, there’s been a big push to use virtual and online tools — and with good reason.

Data shows that properties that use virtual tours and other data tools sold at higher prices both after the announcement of the pandemic, as well as before the outbreak.

There is very little doubt that Greater Vancouver’s real estate market came to a standstill because of COVID-19 but it appears as if buyers are still pursuing the dream of homeownership. While it may take a few more months for the economic impact of the pandemic to work its way through the economy, and GVA’s housing market, it appears the real estate industry is well-positioned to help both buyers and sellers use tools to complete a sales transaction. This ability to continue providing essential services to buyers and sellers will provide stability to the market and, eventually, help the property market to fully recover.

Methodology

To develop a method to examine price differences and the impact the pandemic has had on property pricing, Roomvu examined average sale prices and assessed values pre-COVID (period between Jan. 1, 2020 and March 14, 2020) and compared this with average sales prices and assessed values post-COVID (period between March 15, 2020 and April 30, 2020).

Responses