In this article, we use Sold MLS real estate data to uncover which Vancouver neighbourhoods are a better investment over-time and which Vancouver neighbourhoods depreciate the most when looking at the condo market.

Home investments can be the difference between early retirement and late retirement for Vancouver Home Buyers.

Like anything, homes depreciate with age too. But unlike smaller investments such as electronics and cars, with home depreciation, you could be putting a major dent in your savings account just by choosing to invest in one neighbourhood over another.

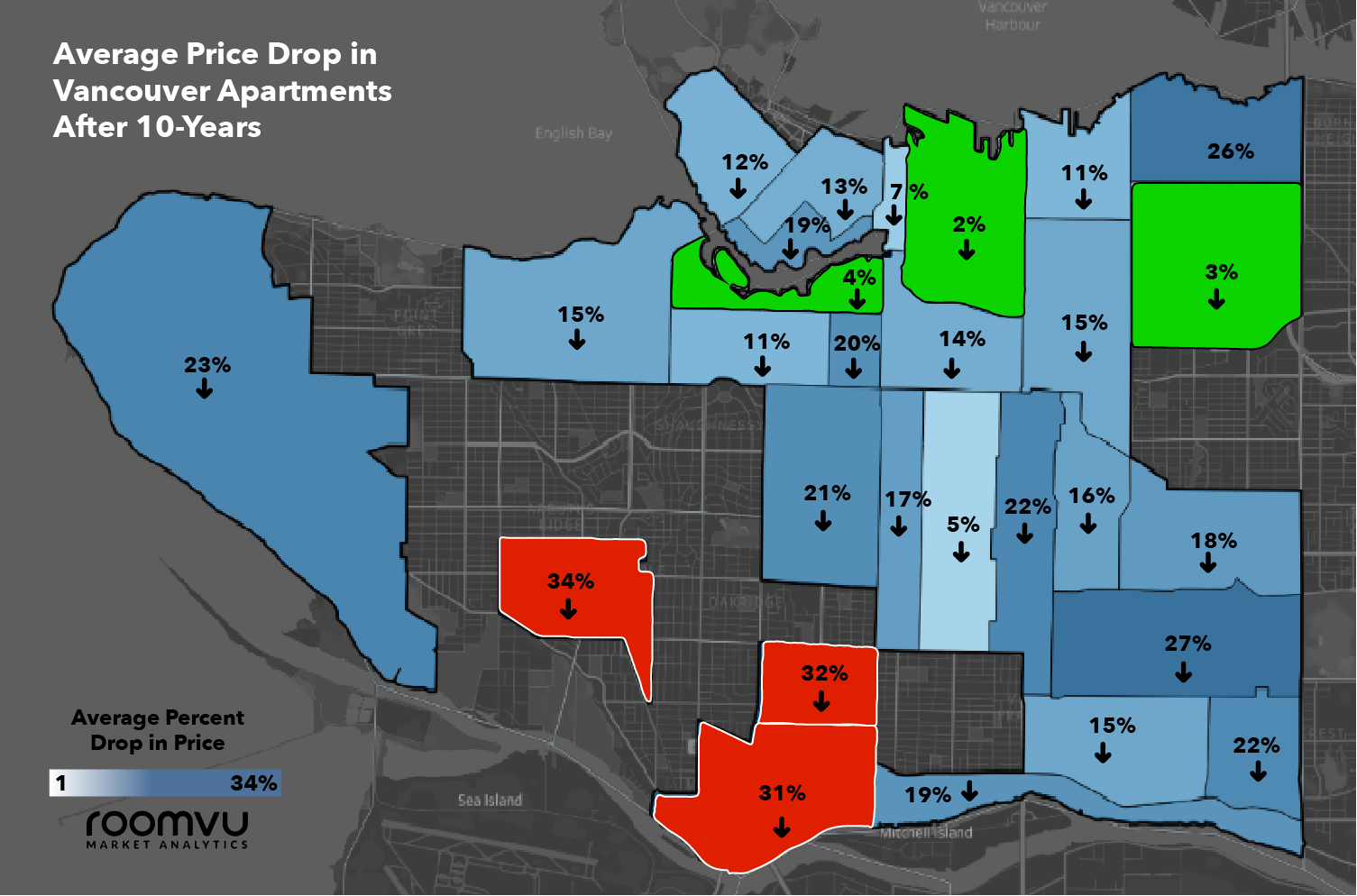

Real-time MLS data shows that you could save an upward of 33.58%, just by strategically choosing where you live in Vancouver. For instance, if you live in Kerrisdale, your newly bought home purchased at $550,000 may only be worth $365,310 an overall depreciation of $184,690 approximately 10-years later (Figure 1). This is if you strictly look at condos with in the same market condition.

What is home depreciation and why should I care?

Home depreciation is a loss in value over time due to age, wear-and-tear and natural deterioration. In other words, the home value decreases to allow for the expense it will cost to repair.

An easy example of this is buying a new car versus a used car. A used car would cost $30,000 off the lot. But the price for that same car used would be $15,000. But this lesser price is to compensate for wear and tear it may have faced with its previous owner. For example, it may need a new engine ($6,000), new paint ($2,000), brakes ($2,000), etc.

The point is, home depreciation is something that shouldn’t be ignored as savings could be the difference between retiring early and working your whole life.

By going for 10 years old, or older condo in these subareas, Vancouver home buyers can save up to 33%:

- Kerrisdale 33.58% price drop over 10-years

- South Cambie 31.65% price drop over 10-years

- Marpole 31.08% price drop over 10-years

By going for 10 years old, or older condo in these subareas, Vancouver home buyers won’t necessarily get a deal:

- Strathcona 2.32% price drop over 10-years

- Renfrew 2.70% price drop over 10-years

- False Creek 4.45% price drop over 10-years

Figure 2: Percent at which Vancouver apartments depreciate. Newly built (0-1 years old) older (6-15) years old).

Figure 2: Percent at which Vancouver apartments depreciate. Newly built (0-1 years old) older (6-15) years old).

What the report looked at:

Deprecation of apartment prices from newly built (0-1 years old) to already-built (6-15) in 2018 and 2019.

How it was calculated:

The data was calculated by taking the difference in the average price of 1-6 aged apartments and 6-15 aged apartments to determine the average drop in price. The drop in price was then divided again to determine the per cent of the price drop.

Data disclaimer:

Subareas that have been greyed out and not included either: There was not enough data for either newly-built or older homes for this region.

What the data shows:

- Vancouver West depreciated more than Vancouver East

- The South depreciates more than the North

- Downtown remains stable

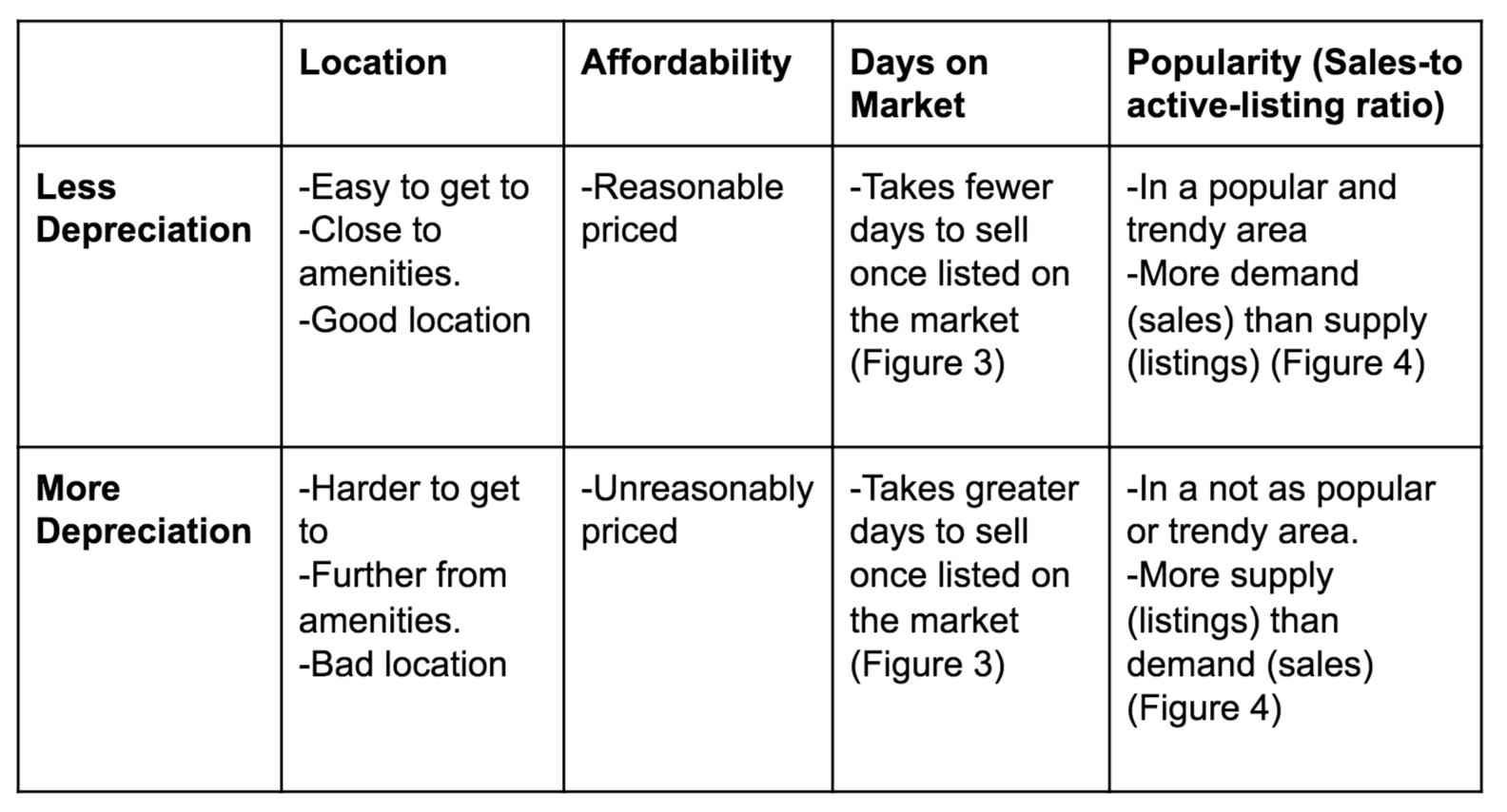

Key factors that could lead to depreciation for Vancouver home buyers:

Conclusion

Like anything and everything, homes depreciate in value. But your most expensive investment should not cost you the most in depreciation, stripping away your life’s savings you worked so hard to earn. By spending your hard-worked dollars smarter, in real estate, for instance, you can salvage depreciation by up to 30%, which depending on the cost of the house could be anything from $100K to $1M. Imagine what you would be able to do with this money?

This said the takeaway is to invest in Vancouver East versus the West, good quality older homes versus newer homes, and factor in the key components that increase the depreciation rate such as location, affordability, days on the market and popularity.

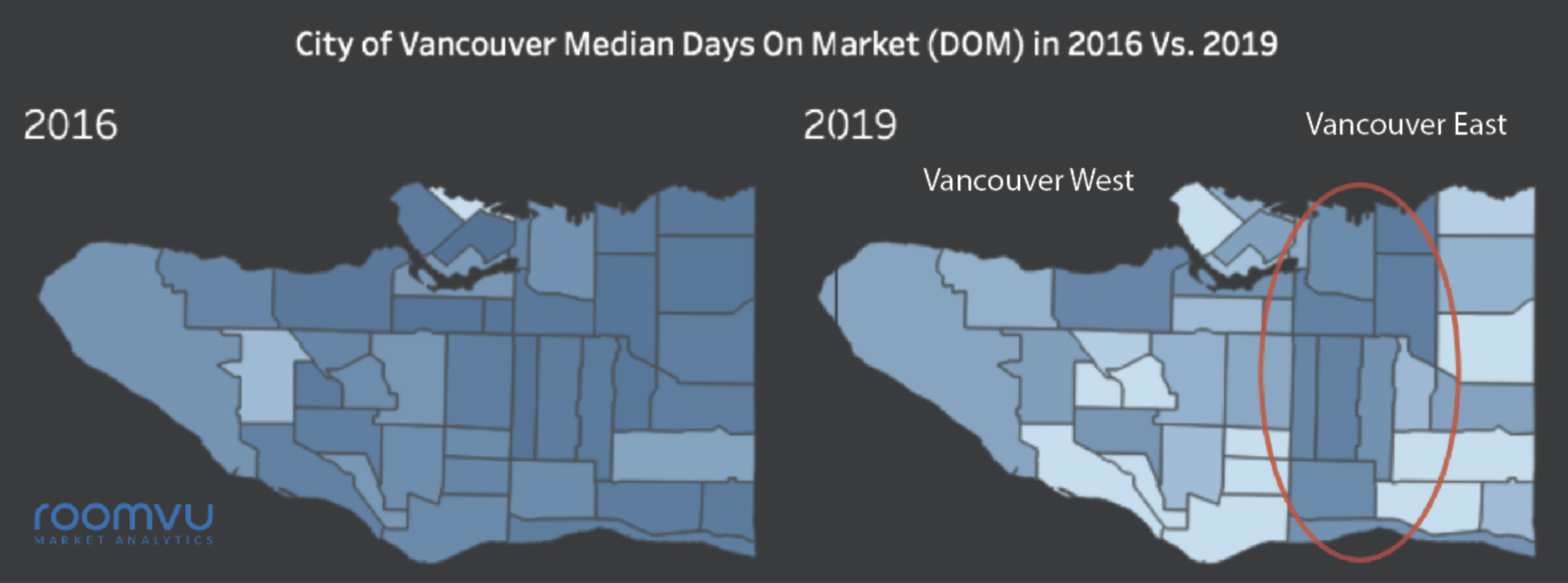

Figure 3: Median Days on the market (dark blue shorter days; light blue longer days).

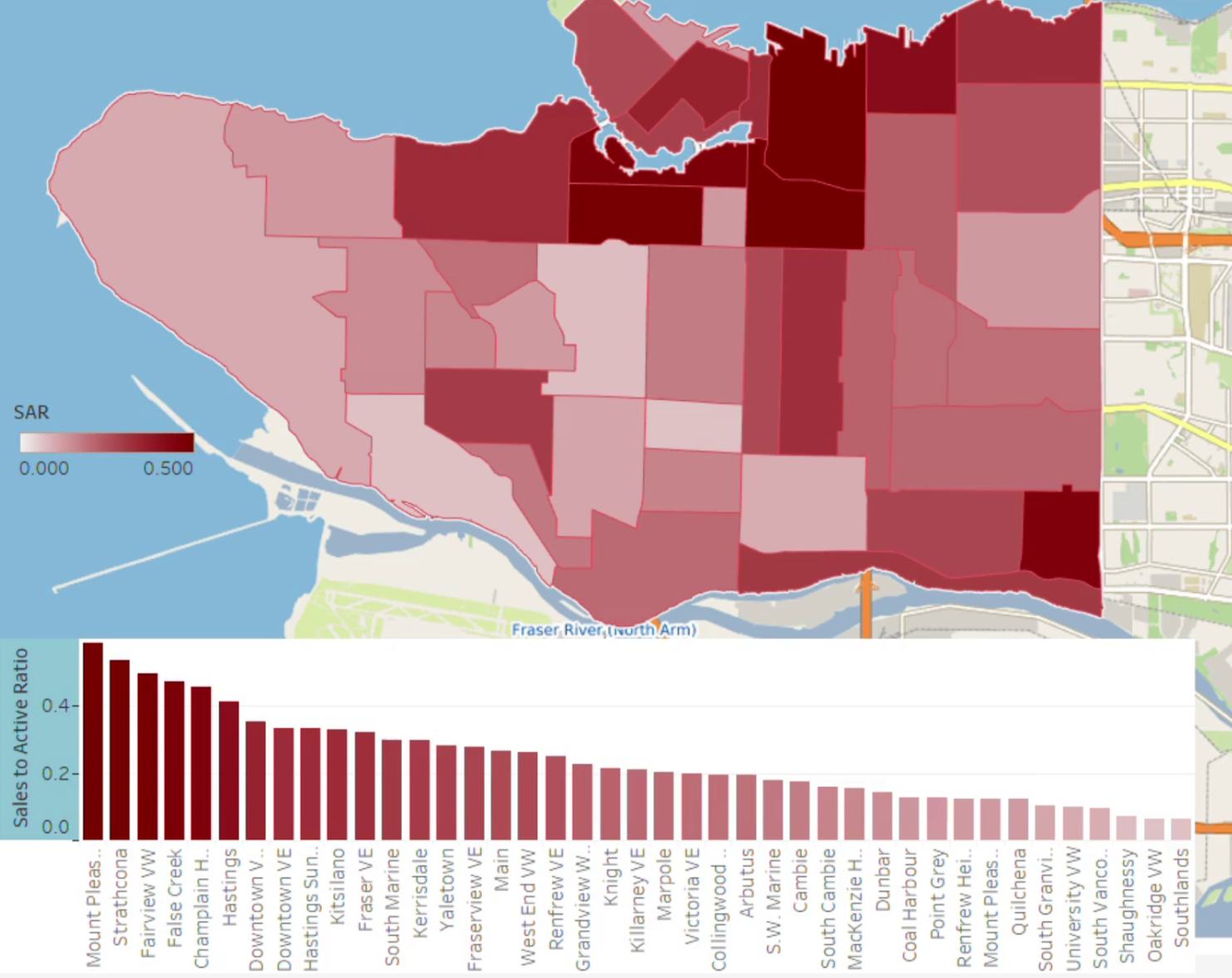

Figure 4: Sales-to-active-listings ratio for October 2019

Want more real estate housing market data? Subscribe here.

Are you a realtor looking for more content? Subscribe here.